UnionBank

UPAY for MSME: Helping level the playing field for the country’s growing number

of MSMEs

Filipinos

are now utilizing digital payments more than ever. Last month, the Banko

Sentral ng Pilipinas reported that digital payments made up 20.1 percent of all

transactions in 2020, more than double the figure from two years ago of 10

percent. This strong momentum is creating opportunities particularly for

enterprising Filipinos who engage in e-commerce.

To help micro, small, and medium

enterprises (MSMEs) in the country capitalize on this growing trend, Union Bank

of the Philippines (UnionBank), the region’s digital trailblazer and the

country’s foremost bank for MSMEs, has launched a groundbreaking feature that

will make e-payments easier and secure not only for customers but also for

MSMEs—the new UPAY for MSME.

|

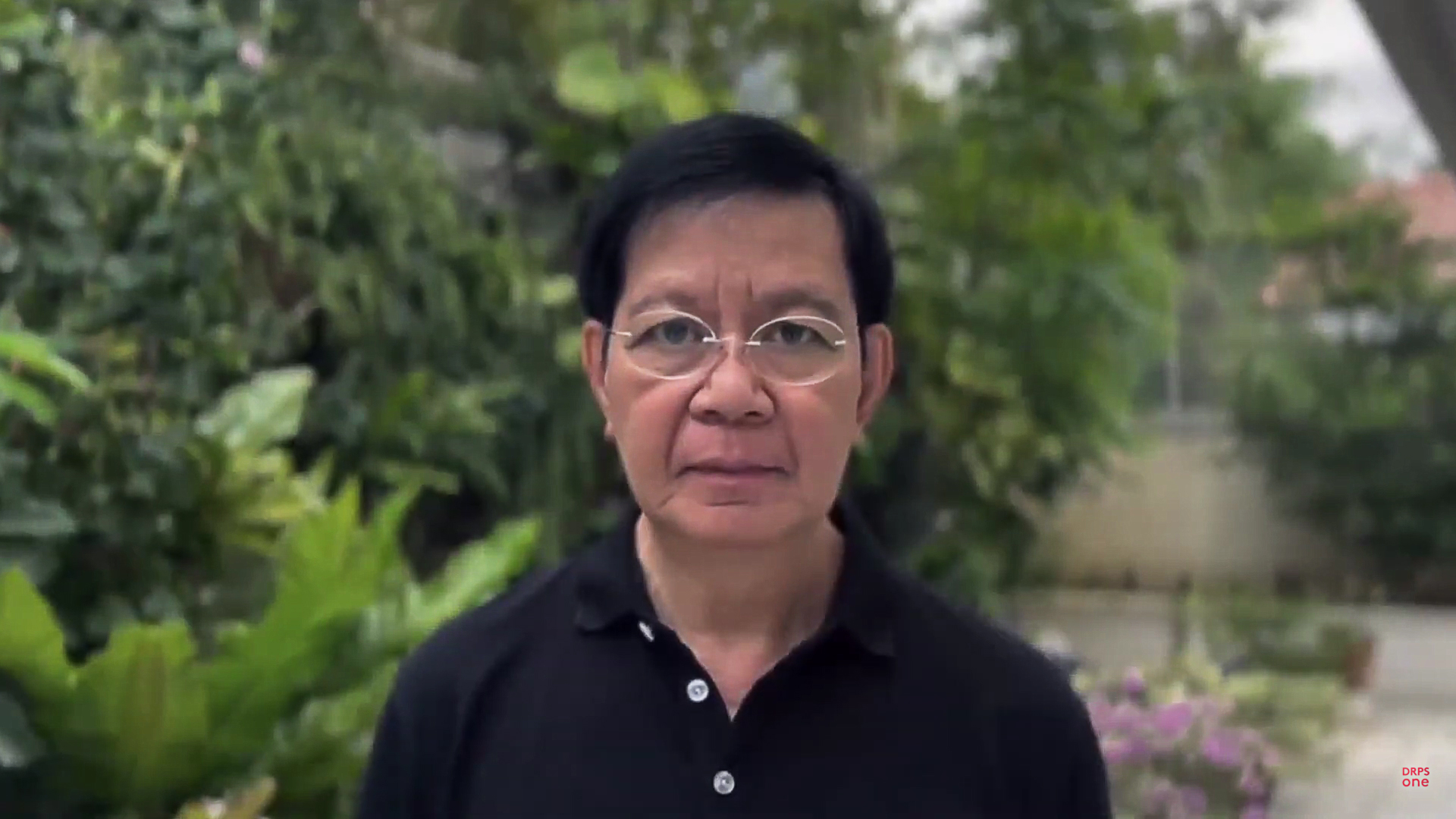

| Jaypee Soliman UnionBank Vice President and MSME Segment Head |

This was unveiled at the

Bank's 12th E-TalkTales media event, wherein UnionBank Vice President and MSME

Segment Head Jaypee Soliman, and UnionBank Merchant Acquiring and Payment

Gateway Head Gerry Austria led discussions on the critical role of digitizing

payments in the country's fast evolving market.

Soliman

began the discussions by talking about the state of digital payments in the

country, citing the significant growth in the number of Filipinos who utilize

these payment solutions. This is an indication that Filipinos are now more open

to the idea of becoming a cash-lite society.

“This shows how the consumers

are now transacting digitally. They are ready. They are there. The number of Filipinos

having e-wallets and bank accounts continue to grow. But the question is, are

the MSMEs ready to accept digital payments?"

This

is where UPAY comes in. UPAY is a groundbreaking digital payments solution

designed to make acceptance of multiple payment options accessible to MSMEs. It

offers a fully integrated, single platform payment collection complete with

other features that can make inbound payments easier for entrepreneurs,

including the option to generate payment links with multiple collection

channels, and the option to generate InstaPay QRPH for digital and physical

channels.

"UPAY

for MSMEs is a payment gateway that is embedded in our MSME Business Banking

App. Businesses of all sizes and types now have the power to generate payment

links, request payments, send it to their customers and provide multiple

payment options, all these reconciled and credited to a single UnionBank

account," Soliman said.

What makes UPAY convenient for

accepting payments is that customers can choose their preferred payment channel

either via Unionbank Online, InstaPay, Other Digital Wallets, Credit/Debit

Cards and even over-the-counter through UnionBank’s expansive network of

partner channels nationwide.

|

| Gerry Austria UnionBank Merchant Acquiring and Payment Gateway Head |

"When

we conceptualized UPAY for MSMEs, we wanted to do away with all the different

hassles that the merchant is experiencing to set up his payments, one of which

is having to connect to a point-of-sale system, having to have different

devices, having to have to download different apps," Austria said.

"Second,

it's the efficiency in doing business. You don't need to be in your physical

store to actually have a customer pay you. You can actually be vacationing

somewhere else and someone wants to buy a product which they saw through your

post on Instagram or Facebook. You can actually just create a payment link and

send it to that customer, so it's very convenient for both the merchant and the

customer," Austria added.

Through

the new feature, UnionBank wants to level the playing field for MSMEs by making

the feature accessible to them, which was previously only available to the

bigger merchants as part of enterprise platforms that are too technologically

demanding and expensive for smaller players.

For more information about the company and this article, please visit

.jpg)